In other news, Splunk announced that it has hired former Lyft Inc. The layoffs were framed as part of a “broader set of proactive organizational and strategic changes” that also include changes to its business processes and cost structure, designed to ensure it can balance growth with profitability in the months to come.

Last month, the company announced it would lay off about 325 employees, representing 4% of its total staff, with most job losses coming in its North American offices.

Now, though, its revenues and outgoings have come in sync, enabling the company to generate a profit.”Īs impressive as its performance was, Splunk understands that it’s not immune to the macroeconomic forces affecting the wider technology industry, and it has taken steps to mitigate their impact. And because of uncertainties, management didnt provide a.

SPLUNK STOCK FULL

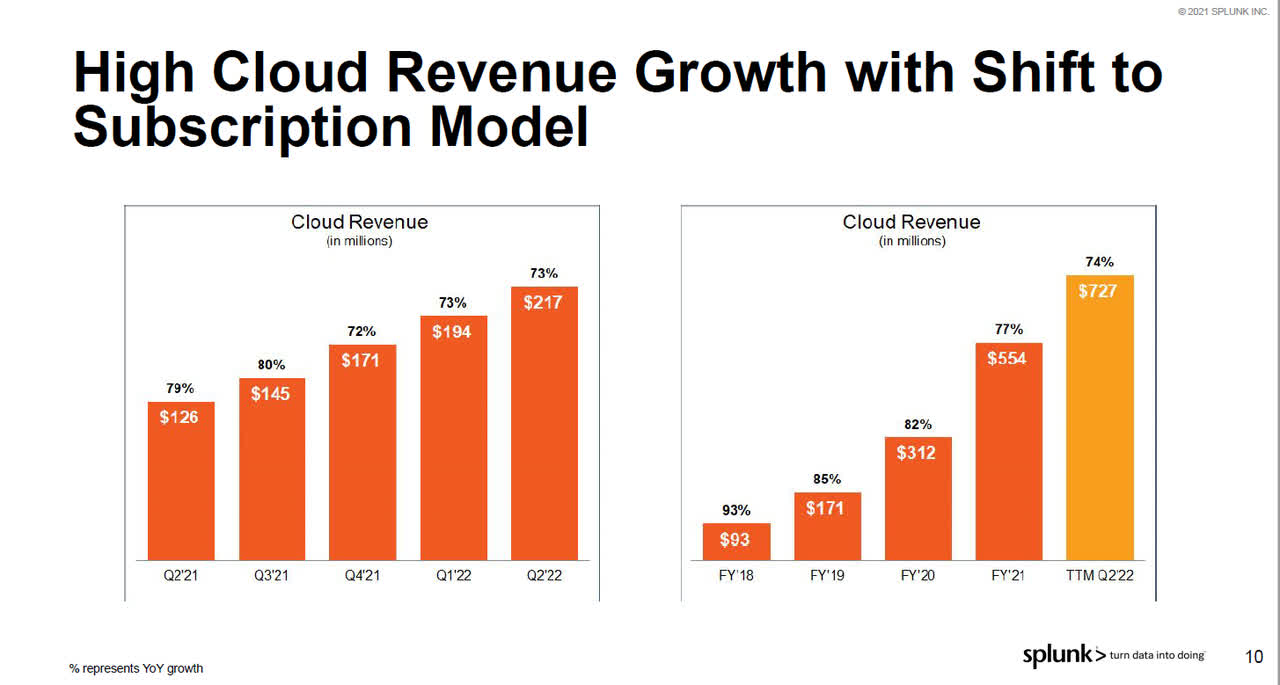

“For years, Splunk was operating on a cost base that it would only be able to pay for in the next full year. Splunk stock is not a bargain yet In addition to those financial challenges, Splunks transition to the cloud remains a work in progress. “Gary Steele and team have managed to grow the company’s revenue by almost $1 billion, while slightly reducing its operating expenses,” he said. said Splunk seems to have turned a corner by achieving profitability in the last quarter. Holger Mueller of Constellation Research Inc. Maintenance and services generated an additional $167 million, flat from the year before. Cloud revenue, which has grown much faster in previous quarters, rose by 43%, to $413 million.

SPLUNK STOCK SOFTWARE

The enterprise search software companys stock was down roughly 1 as of 2:30 p.m.

SPLUNK STOCK LICENSE

Surprisingly, much of Splunk’s growth in the previous quarter was driven by license revenue, which rose 50% from a year ago, to $670 million. Shares of Splunk (NASDAQ: SPLK) are seeing big swings in Thursdays trading. Its tools are popular, used by thousands of enterprises. It also offers tools for dealing with cybersecurity incidents such as data breaches. The company is the creator of a popular data processing platform that’s used by large enterprises to detect and troubleshoot technical issues within their information technology infrastructure.

SPLUNK STOCK FREE

“As we begin our new fiscal year, we remain committed to delivering durable growth and substantially increasing free cash flow.” “Splunk plays a critical role in helping our customers ensure their digital systems are resilient, secure and able to adapt to constant change,” he said. For the full year, it’s targeting sales of $3.85 billion to $3.9 billion, below Wall Street’s forecast of $4.02 billion.Ĭhief Executive Gary Steele (pictured) focused on the positives, hailing the company’s “solid finish” to an important year. For the first quarter, it expects revenue of between $710 million and $725 million, quite a bit below the analyst consensus estimate of $807.2 million. However, the company is bracing itself for tougher times ahead. The strong performance saw Splunk swing from a loss of $141 million a year earlier to record a net profit of $269 million for the quarter. For the full year fiscal 2023, it reported total revenue rose 37%, to $3.654 billion, with cloud revenue growing an even more imprssive 54%, to $1.475 billion. Wall Street had been targeting earnings of just $1.14 per share on sales of $1.08 billion. The company had just delivered strong fourth-quarter results, reporting earnings before certain costs such as stock compensation of $2.04 per share on revenue of $1.25 billion, up 39% from a year earlier. Here are Wednesday’s biggest analyst calls: Apple, Tesla, SoFi, ServiceNow, Meta, Netflix, Splunk and more. All Rights Reserved.Big-data company Splunk Inc.’s shares fell almost 3% in extended trading today after it gave a first-quarter and full-year outlook that came in far below Wall Street’s targets. All content of the Dow Jones branded indices © S&P Dow Jones Indices LLC 2019 and/or its affiliates. Standard & Poor's and S&P are registered trademarks of Standard & Poor's Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. Jose Felipe Lopez, Engineering Manager, Rappi. Dow Jones: The Dow Jones branded indices are proprietary to and are calculated, distributed and marketed by DJI Opco, a subsidiary of S&P Dow Jones Indices LLC and have been licensed for use to S&P Opco, LLC and CNN. We’re all attuned to the potential business impact of downtime, so we’re grateful that Splunk Observability helps us be proactive about reliability and resilience with end-to-end visibility into our environment. Chicago Mercantile Association: Certain market data is the property of Chicago Mercantile Exchange Inc. Factset: FactSet Research Systems Inc.2019. Market indices are shown in real time, except for the DJIA, which is delayed by two minutes.

0 kommentar(er)

0 kommentar(er)